EAS x Easyship

The best tax solution meets the best shipping solution

Sell easily to EU & UK with EAS

EAS all-inclusive OSS, IOSS, EU and UK VAT services make your EU sales stress-free and easier than ever.

We handle the complex so you can focus on your customers.

- IOSS, OSS, Non-union OSS and EU VAT

- No starting fees, no monthly fees

- No-code, no manual work

- Add EAS UK extension to cover EU + UK *

We make your

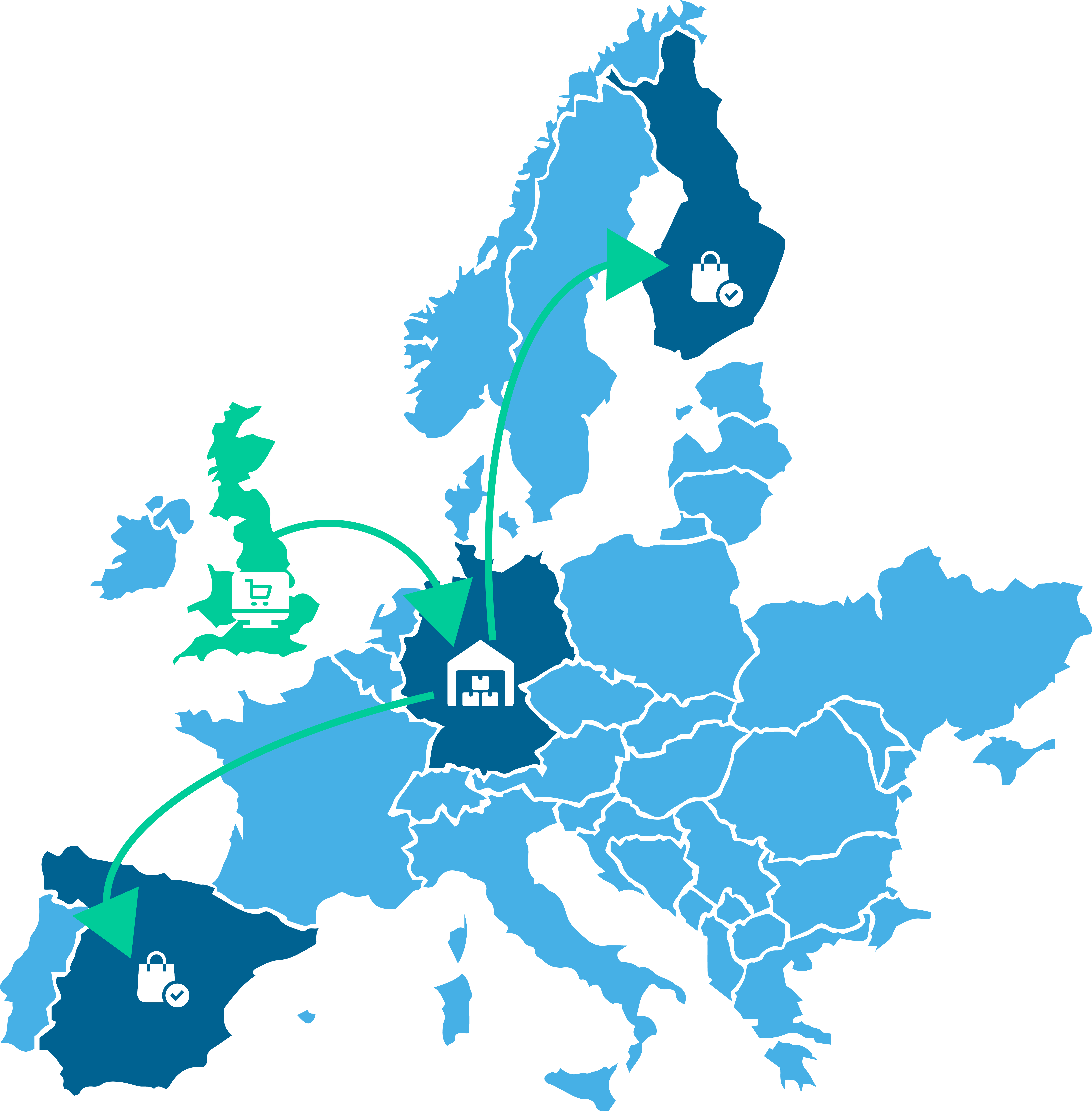

cross-border sales easy

Full VAT automation

Internationalization and business expansion create tax obligations. We are here to automate your taxes and reporting, no matter the business model or location. You can focus on your customers and building your business.

IOSS Intermediary service

EAS Intermediary service is included in the all-inclusive IOSS service, without any starting fees or monthly fees.

Have a talk with us about how we can help your business

What's included?

Smart VAT calculator

Increase you profits by selling with the lowest possible VAT rate. We calculate the taxes based on your customers location.

Opitimized VAT rates

EAS uses database of more than 600.000 reduced VAT rules to optimize your sales taxes.

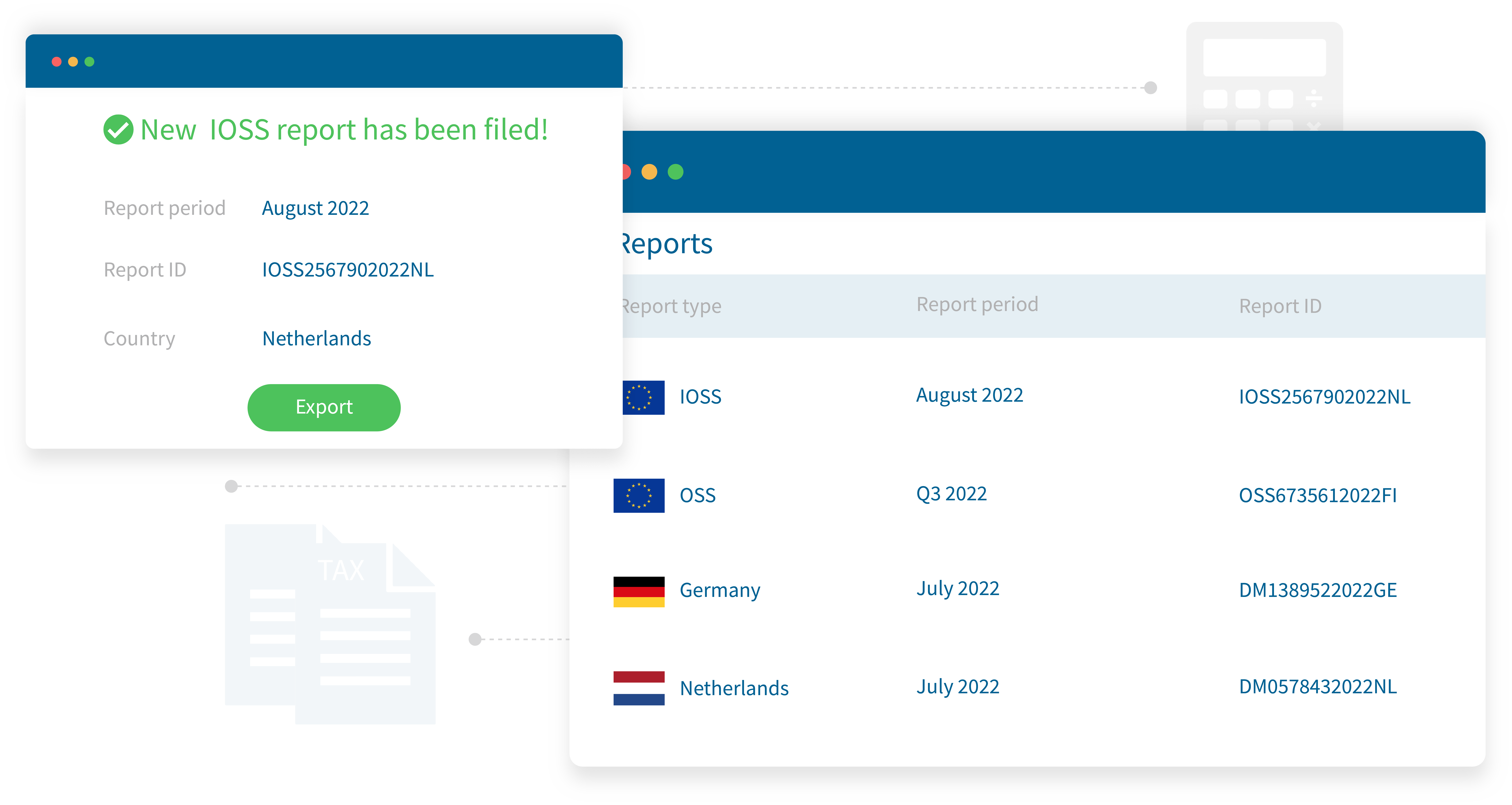

Automated VAT reporting

Save money and time with full automation

All reports are from a single source and fully automated with EAS.

While saving money and time with automated IOSS, OSS and VAT reports.

EAS also recognizes your VAT obligations automatically and starts to create the correct reports instantly.

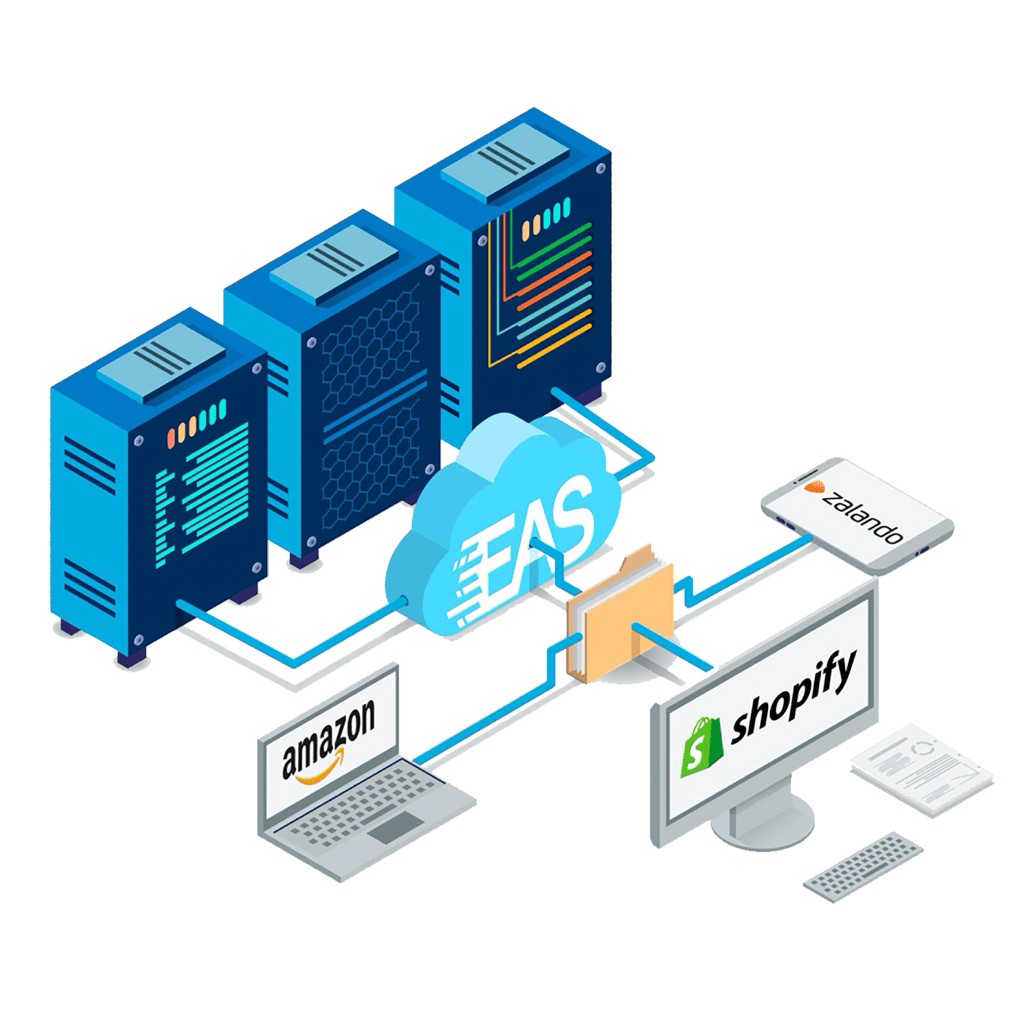

No-code connection

EAS can be easily connected to multiple eCommerce platforms and marketplaces.

Onboarding with EAS does not require a technical team or external coders. EAS can be installed directly from Shopify, WordPress and Magento App Stores.

You can easily connect your Amazon, eBay and CDON accounts with EAS.

If you need help with installation, EAS tech team makes the connection free of charge!

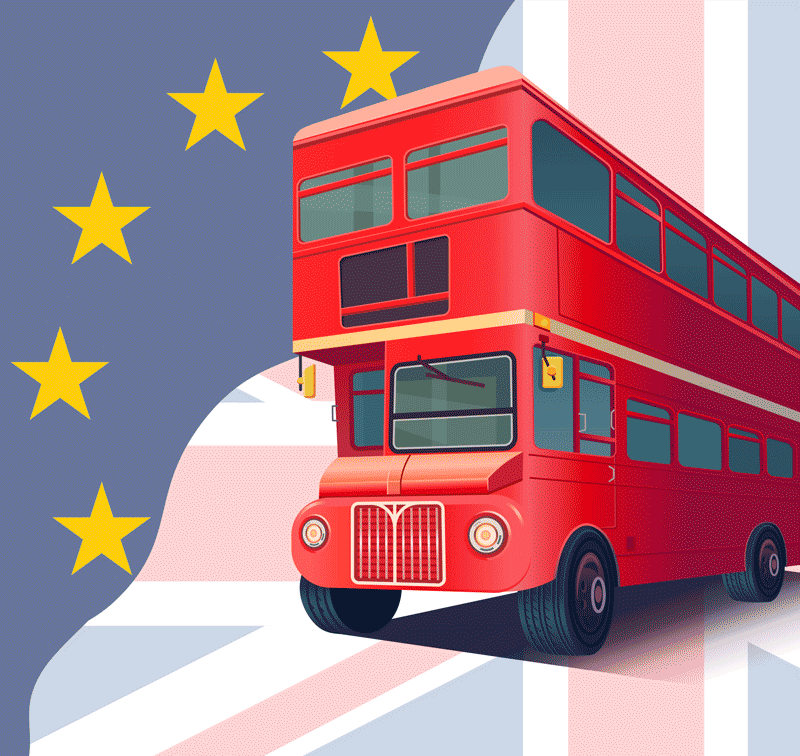

Covering EU + UK!

Introducing the EAS UK extension!

You can easily extend the EAS EU solution to cover United Kingdom with the new UK extension.

EAS has extended its full automation to cover UK. With a single tool, you cover more than half a billion consumers. The UK extension works through the same plugin as the EU automation.

EAS calculates UK VAT, creates VAT reports, files the reports, and invoices and pays the required VAT.

IOSS & OSS registration

Do you need IOSS registration or intermediary? Or assistance with OSS Registration?

EAS helps you with all the registrations!

IOSS registration and intermediary services are included in the inclusive IOSS transaction fee.

VAT obligation mapping

Are you spending time and money researching your tax obligations?

EAS maps automatically your obligations, so you don’t have to spend time talking to tax experts (no one wants to do that).

How to get started

Onboarding is made easy and quick, you can do it yourself or let the EAS tech team handle the whole onboarding and installation for free.

If you have questions or you need technical help:

3. Start selling

EAS calculates taxes and genetares reports automatically, you just need to sit back and enjoy.

Install

For self-installation download the EAS Plugin from the following locations:

Do you want EAS tech team to handle the registration, installation and setting up?

Not sure how it works for your business?

Talk with our E-commerce expert!

We’ll help you every single step of the way. We know taxes so you don’t have to!