IOSS

Automate IOSS registration, filing, and reporting for all your EU orders.

We also offer tailored solutions for marketplaces, print-on-demand platforms, and logistics companies.

IOSS | VAT for Software | OSS | UK VAT | GPSR | Swiss Post DDP

EAS automates VAT, IOSS, and product safety compliance, so you can sell to Europe without mistakes, complexity, or manual work. From your first sale to international growth, our compliance solution scales with you and keeps your business fully compliant.

We also offer tailored solutions for marketplaces, print-on-demand platforms, and logistics companies

IOSS | VAT for Software | OSS | UK VAT | GPSR | Swiss Post DDP

EAS automates the full compliance lifecycle in EU and UK. From the moment a customer places an order to the final tax payment, every step is taken care of in the background. Whether you’re selling physical goods, digital services, or regulated products, EAS keeps your business compliant, accurate, and audit-ready without the manual work.

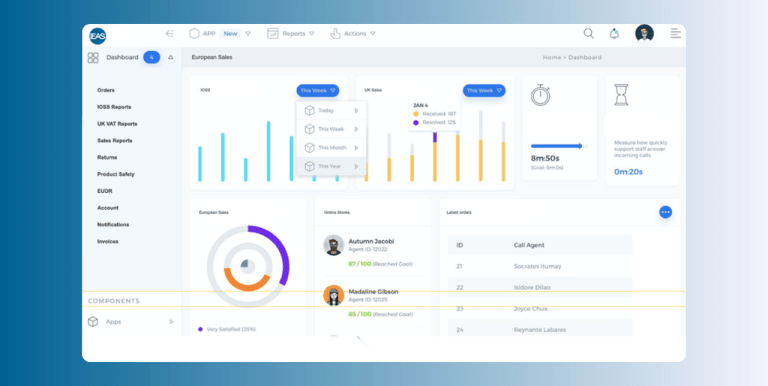

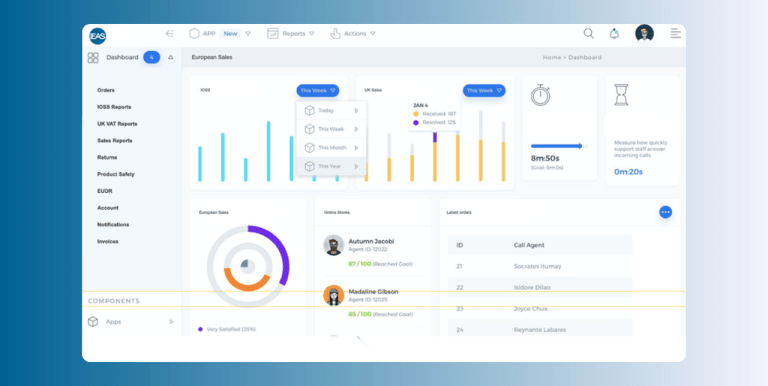

EAS automatically collects, validates, and structures all necessary sales, transaction, and product data directly from your store or platform. It supports multi-channel setups including webstores, marketplaces and more complex sales networks with no need for manual input or data handling.

This ensures complete accuracy across your EU and UK sales, providing real-time, reliable data for seamless compliance and peace of mind in these markets.

EAS prepares, validates, and submits your VAT, IOSS, and OSS reports directly to EU and UK tax authorities, with every step fully automated to ensure timely and correct filings. You no longer need to manage spreadsheets, handle manual uploads, or worry about reporting deadlines and complex cross-border tax rules.

EAS takes care of the entire reporting lifecycle for you, allowing you to stay fully compliant without unnecessary administrative work or risk of mistakes.

When goods are returned, EAS automatically updates your tax reports to reflect the correct VAT amounts, ensuring your filings always match the true value of your sales after refunds. In addition to handling tax adjustments, EAS manages the preparation of your monthly VAT, IOSS, and OSS payment summaries so you can stay on top of your tax obligations with accurate, up-to-date figures.

EAS helps you avoid overpayments and keeps your compliance effortless.

For products that fall under EU safety regulations, EAS creates, manages, and keeps up to date all required documentation, including declarations of conformity and product information files. Everything is handled automatically to stay aligned with GPSR and other relevant rules.

This ensures your products are always backed by the right documentation for smooth market access, compliance checks, and inspections across the EU without added work on your end.

IOSS | VAT for Software | OSS | UK VAT | GPSR | Swiss Post DDP

EAS automates the full compliance lifecycle. From the moment a customer places an order to the final tax payment, every step is taken care of in the background. Whether you’re selling physical goods, digital services, or regulated products, EAS keeps your business compliant, accurate, and audit-ready without the manual work.

Automated Data Collection

We pull, structure, and validate your sales and product data directly from your store or platform — even across multiple channels. Always accurate, always up to date.

Automated EU & UK Reporting & Filing

EAS handles all VAT, IOSS, and OSS reports and submits them to EU and UK tax authorities. No uploads, no deadlines to chase — full compliance, always on time.

Automated Returns & Payments

When returns happen, EAS adjusts your tax reports automatically. We also compile your payment summaries monthly so your VAT payments are always correct.

Automated Safety Documentation

Selling regulated goods? We manage declarations of conformity and product files for GPSR and more. Your products stay market-ready — with zero manual upkeep.

IOSS | VAT for Software | OSS | UK VAT | GPSR | Swiss Post DDP

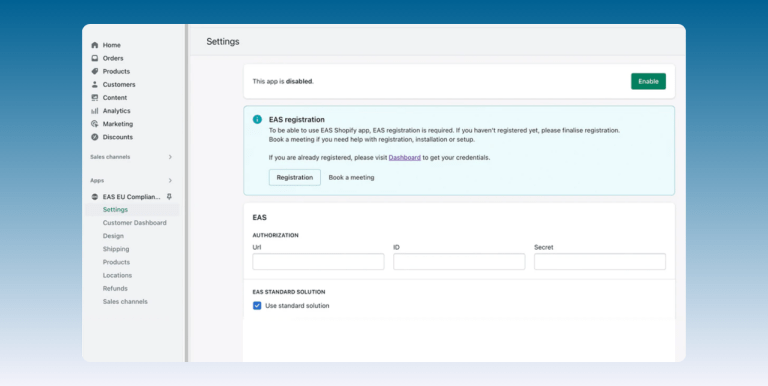

Shopify WooCommerce Wix Shopware OpenCart API CSV

EAS offers a complete suite of compliance services through a single, automated platform.

From tax reporting to product safety, every solution works together seamlessly, so you can manage all your EU and UK obligations in one place, with zero manual work.

Whether you need standard coverage or a tailored setup, EAS adapts to your business and scales as you grow.

EAS provides a fully automated IOSS solution for seamless VAT compliance when selling to EU customers.

We manage the complete process from IOSS registration to Shop configuration, integration, VAT calculation, reporting, and payments. Our solution integrates directly with your e-commerce platform, removing manual work and ensuring your cross-border sales to Europe remain fast, accurate, and fully compliant.

EAS offers a complete VAT compliance solution for businesses selling digital products, software, or SaaS to customers in the EU and UK.

Our platform automates VAT registration, tax calculation, and reporting, supporting both current and past periods. We cover the EU Non-Union OSS scheme and UK VAT, handle high-volume digital transactions and micro-payments, and integrate directly with your platform or via API for simple, scalable tax management.

EAS provides a fully managed UK VAT solution for seamless compliance when selling to UK customers.

We help you to get VAT registered, and automate reporting, Making Tax Digital requirements, and automated VAT adjustments for returns. Everything is fully integrated into your e-commerce platform for fast, simple, and fully compliant UK shipping.

AS provides a fully automated OSS solution for effortless VAT compliance on digital sales to EU consumers.

We collect sales data directly from your e-commerce platform, categorise transactions by destination country, and handle all OSS reporting and VAT submissions through a single interface. Our system also adjusts VAT for returns automatically and ensures your filings are accurate, timely, and fully compliant. Everything runs in the background — no manual work – just smooth EU-wide sales.

EAS partners with Swiss Post to offer a fully managed DDP solution for shipping from Switzerland to EU customers — for all order values, especially for deliveries above the IOSS threshold.

We handle customs declarations, VAT and duty payments, and export documentation to ensure your packages arrive without additional charges or import delays. Our service requires no EU VAT or OSS registrations, includes automated tax corrections for returns, and offers fast, cost-effective shipping with Swiss Post DDP — all fully integrated into your e-commerce platform in as little as 72 hours.

EAS helps companies comply with the EU General Product Safety Regulation by serving as your EU Authorised Representative.

We handle product registrations, provide labelling instructions, and generate required Declarations of Conformity. Our service ensures your products meet all safety regulations quickly and affordably. Combining automated processes with expert support, we typically complete GPSR compliance within 48 hours.

EAS powers compliance at scale, with infrastructure trusted by postal networks, marketplaces, and global platforms.

EAS provides custom integrations, modules, and full compliance infrastructure for those who serve large numbers of merchants or manage large-scale operations. Whether you’re a postal operator, courier, marketplace, eCommerce platform, or Print-on-demand provider, we tailor our automation engine to fit your ecosystem.

EAS offers a complete suite of compliance services through a single, automated platform.

From tax reporting to product safety, every solution works together seamlessly, so you can manage all your EU and UK obligations in one place, with zero manual work.

Whether you need standard coverage or a tailored setup, EAS adapts to your business and scales as you grow.

Fully automated IOSS when selling physical goods to EU

EAS automates your entire IOSS process — from fast registration to VAT calculation, reporting, and payments. Fully integrated with your store for fast, compliant EU sales. No manual work needed.

Fully automated European VAT for software, services and SaaS

Sell software, SaaS, or digital products to the EU or UK? EAS automates VAT registration, calculation, and reporting — including past sales. Supports Non-Union OSS & UK VAT, with API or platform integration.

Fully automated UK VAT for UK sales

EAS manages your UK VAT registration, reporting, and compliance — including returns and Making Tax Digital. Fully integrated with your store for fast, simple UK selling.

Register for EAS UK VAT Solution

Fully automated OSS for intra-EU sales

EAS automates VAT reporting for EU digital sales — no manual work needed. We collect your sales data, handle country-based VAT, adjust for returns, and file through one simple interface.

Automated Product Safety Compliance

EAS helps companies comply with the EU General Product Safety Regulation by serving as your EU Authorised Representative. We handle product registrations, provide labelling instructions, and generate required Declarations of Conformity. Our service ensures your products meet all safety regulations quickly and affordably. Combining automated processes with expert support, we typically complete GPSR compliance within 48 hours.

Read more about EAS GPSR Solution

Taxes and duties paid deliveries from Switzerland

Ship from Switzerland to the EU — for all order values, especially over the IOSS threshold. EAS handles VAT, duties, customs declarations, and return adjustments. No EU VAT or OSS needed. Fully integrated, fast, and hassle-free.

Read more about Swiss Post DDP

Advanced and customised solutions

Built for Scale – EAS powers compliance for postal networks, marketplaces, and global platforms. We offer consultation, integrations and automation for those serving many merchants or running large-scale operations.

Book an Enterprise meeting

Transparent IOSS, OSS, UK VAT, Digital VAT, and GPSR pricing with full automation for EU and UK compliance.

Sell across borders with correct VAT, accurate reporting, and complete product safety compliance.

Automate IOSS registration, filing, and reporting for all your EU orders.

VAT compliance for digital products and services sold in the EU and UK.

Automated VAT reporting and filings for your UK ecommerce sales.

Centralised EU VAT reporting under the OSS scheme. Automated or self-filed options.

GPSR documentation, compliance checks, and authorised representative service.

Enterprise pricing is structured case by case based on your operational and technical requirements. Book a meeting for more information.

Reviews

BLCKSMTH Apparel

October 4, 2025

“EAS has helped simplify something that would otherwise be a lot of hassle… EAS Project are the only service we would use to make taxes a EU breeze.”

Brutal Cities

August 26, 2025

“Nice guys, nice system, amazing customer support… Only thing is I wish it was a bit easier and cheaper to pay via PayPal…”

SAIRA

November 21, 2025

“Seamless integration, setup and great customer service. Simplifies something that can often be complex… Highly recommended.”

Deborah Wilde Books

August 5, 2025

“Working with EAS has been fantastic… attentive, responsive and easy to deal with. I don’t know how we would have navigated the EU and UK taxes without them.”

Pawsome Paws Boutique

October 29, 2025

“We have been using EAS’s services for a few years now. Their systems work flawlessly, and the customer service is fantastic. Would have no hesitation recommending them.”

neidan clothing

October 22, 2025

“Absolutely excellent app and customer service… clear, detailed and very generous. Would highly recommend to anyone thinking about using them.”

These reviews come directly from verified users of the EAS Shopify App on the Shopify App Store.

EAS is the highest-rated compliance solution for cross-border eCommerce, trusted by 4,000+ merchants in 60+ countries.

We automate everything – IOSS, OSS, Non-Union, UK VAT, GPSR and customs data, so you can stay fully compliant without spreadsheets, consultants, or manual work.

Get monthly updates from EAS including information on new solutions, VAT and compliance news, webinar invitations and partner highlights.

EAS is built to be fully automated, so in most cases, you won’t need ongoing support to stay compliant. But when you do need help, our dedicated technical and compliance teams are here for you. From onboarding to documentation and platform guidance, we make sure you reach and maintain full compliance with ease.

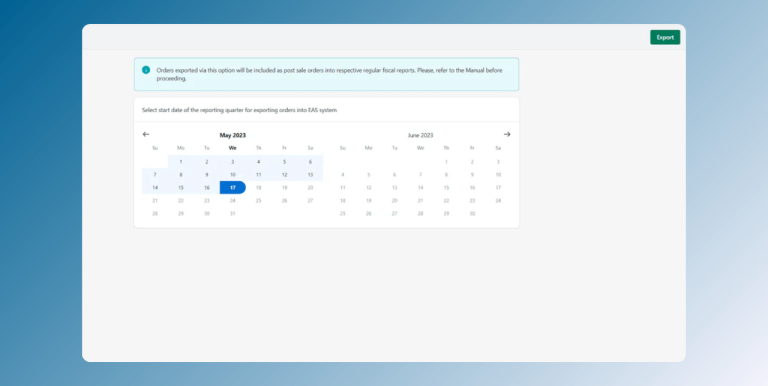

EAS collects your EU sales data, and creates and files the IOSS reports automatically.

With EAS, the IOSS registration takes just seconds.

If you choose our free installation and configuration service, the average onboarding time is less than seven working days, including the IOSS registration and online store configuration.

Start by registering at easproject.com/reg

On average, EAS GPSR onboarding is completed within 48 hours.

Yes, EAS registers companies for unique IOSS numbers. We are a compliance solution provider we make sure you are 100% compliant.

If EAS registers you for IOSS, you are the Seller of record for the IOSS number and EAS is the IOSS intermediary for the number.

You start using IOSS by registering with EAS at easproject.com/reg

Yes! After the onboarding, EAS handles everything. The only thing you need to remember after the onboarding is to pay our monthly invoice 🙂

EAS supports most of the popular eCommerce platforms. EAS supports all sales channels and business models for GPSR service.

For VAT services, currently you can use EAS with:

Yes! On EAS Dashboard you can select your plan for the next reporting period.

Yes! All EAS solutions works through the same EAS Dashboard, and work together seamlessly.

Yes, but most of our customers do not need any compliance consultation, as we automate the whole compliance process. All the basic knowledge, if needed, is included in EAS Plans.

For more extensive consultation, reach [email protected]

Please be aware that tax reporting is conducted either monthly or quarterly, depending on the chosen tax scheme. Therefore, it is possible that the EAS automated system will send you the final invoice, including the value-added tax due, after the end of the sales period.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.