Sell easily to the UK again

Sell to the UK with ease!

We handle all the compliance so you can focus on sales!

The same solution handles the whole EU also, regardless of where you are or where you deliver from. So why not take over the continent since you are at it?

Get started for free

Sales to the UK are easy again!

EAS tools remove the complications from selling to the UK, cost-efficiently, easily, and permanently

Our simple mission is to help your cross-border sales make sense again!

EAS Solution is not just a tool, it is a cross-border revolution with less manual work, less stress, less learning, less barriers and more business!

All-in-one

All accessible automation

Not only EAS automatically calculates VAT charges at check-out, but our plugin also helps you to identify more than 600 000 reduced-VAT rates in the EU.

Your customer knows the whole amount due (including VAT and all applicable customs duties) on purchase and you provide a better customer experience. Learn more

Every cross-border order is logged and managed easily on EAS dashboard.

EAS complies with all VAT schemes such as Domestic, B2B, Import, Union, and non-Union schemes.

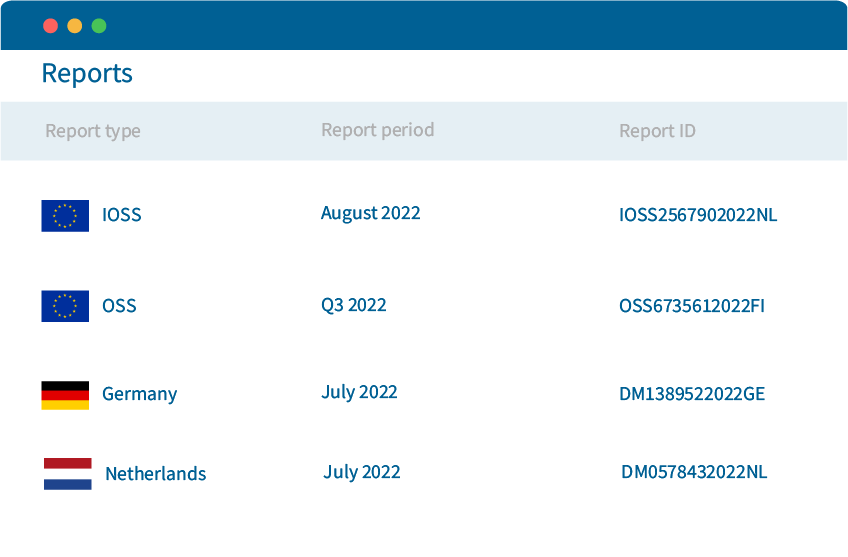

Ready-for-filing VAT reports and extensive-accountant-friendly data are at your disposal.

Easy onboarding & no-code setup

Either set it up yourself or let our dev team help you at every step of the way. We want you to focus on the important which is why we are happy to have the onboarding service for free. Your onboarding and journey to compliance are smooth and fast!

We-have-it-all features

Smart VAT calculator

More than 600 000 reduced rates are applied and optimized. Your customer knows the whole amount due (including VAT and all applicable customs duties) on purchase and you provide a better customer experience.

Registration for OSS / IOSS

Registration for OSS / IOSS special schemes with intermediary services when needed

VAT filing and payment management

Compliance with all schemes, Domestic, B2B, Import, Union and Non-Union schemes.

Invoices and orders management

Access to EAS Merchant dashboard that contains all invoices and reports

Logistics compatible and connected

EAS Solution supports all business models, including multi-warehouse.

Pricing

No starting or monthly fees

Without periodical or upfront costs it would be simply silly not to open your store to the world!

Only pay as you go

Transparent pricing means you will always know your costs.

Transaction based fees are simple and can be charged at checkout from the customer.

UK Extension

For deliveries to UK-

UK VAT registration support

-

Setup service with your platform

-

UK VAT reporting

-

UK VAT reporting

-

Making Tax Digital (MTD)

Start using EAS compliance in 60 min

Sign up with us

Download & set it up with our help

Start selling to the UK!

FAQs

IOSS is an abbreviation for Import-One-Stop-Shop. You can read more about here in our Support.