VAT Calculator

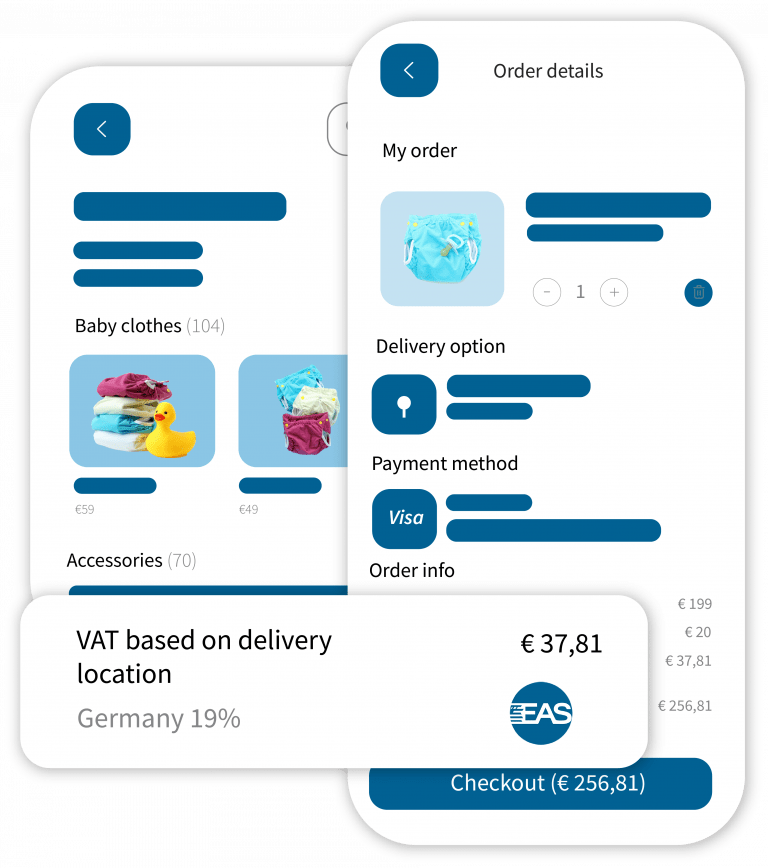

Increase you profits by selling with the lowest possible VAT rate. We can be your VAT calculator and we calculate the taxes based on your customers location.

VAT is not an option, it has to be paid and reported. Simple. As an e-merchant, you are liable, for accuracy and mistakes. All purchases have to be paid according to the VAT rate of the end-customer, not the country of sales or delivery.

The e-commerce softwares have simple, manual VAT functionalities as standard. For us, handling 27 country VATs manually does not sound like a fun way to spend our evenings and weekends.

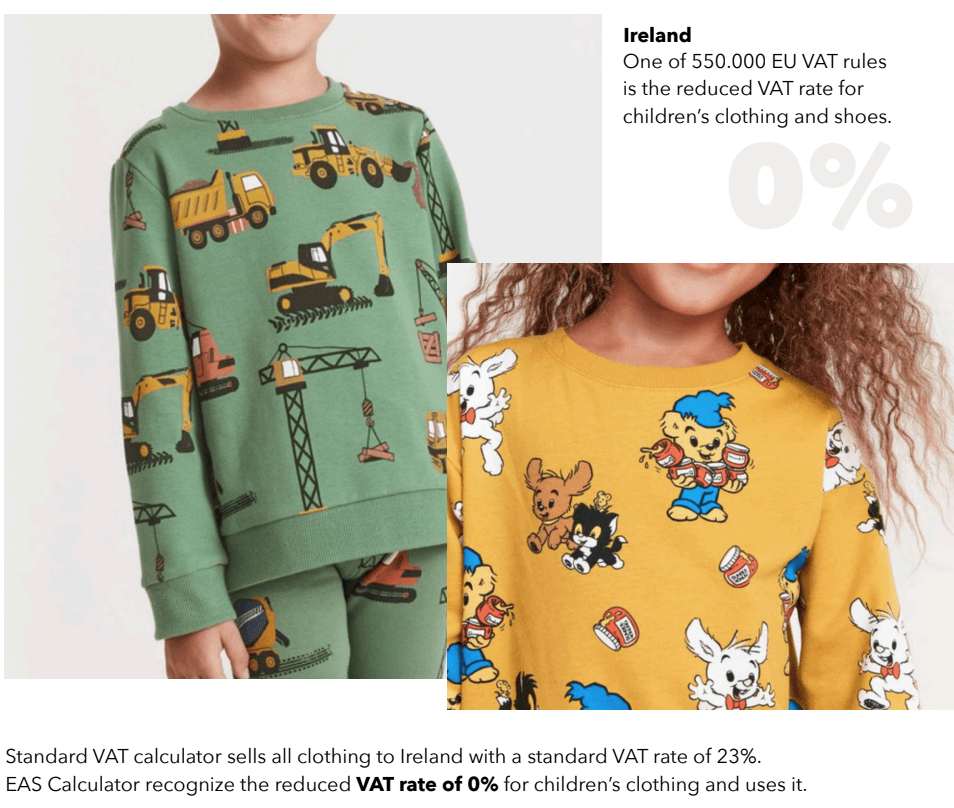

Example:

Let’s say you are selling children’s clothing or shoes to all EU countries. A customer from Ireland wants to buy your amazing product. A standard VAT calculator calculates the VAT rate of 23% (standard VAT rate of Ireland).

We wanted to have an intelligent full landed cost calculator to start with. There are 600 000 exceptions and reduced VAT rates in the EU, you can actually increase your margins with accurate VAT calculation.

To have an efficient VAT calculation, let alone to utilise the reduced rates, universally used HS-codes are required at product data (SKU). We are not strong believers in manual labour, so you don’t have to either; we help you get the codes into your catalogue.

It really is this simple. No shortcuts needed, just get a tool sturdy enough to handle it. We know EAS smart VAT calculator is the only sturdy solution out there.

Not sure how it works for your business?

Talk with our E-commerce expert!

We’ll help you every single step of the way. We know taxes so you don’t have to!