Despite seeming complicated at first glance, IOSS is actually a simplification which is claims to be – at least with EAS it is!

IOSS in a nutshell:

For deliveries from outside of the EU

For goods valued under 150€, not including VAT, shipping or other fees.

Allows collection of EU VAT at checkout

Allows single filing and payment of all EU VAT

Simplified, streamlined customs process

B2C only

Monthly reporting and payment of VAT

The seller must be registered for IOSS to take advantage of the scheme

An intermediary is required for non-EU companies

What is IOSS?

The Import One-Stop-Shop (IOSS) is a simplified VAT collection solution for goods delivered from outside of the EU to EU end-customers. It improves customer experience by facilitating single-action purchases and faster customs handling.

IOSS is the electronic portal businesses can use since 1 July 2021 to comply with their VAT e-commerce obligations on distance sales of imported goods.

The IOSS allows sellers and marketplaces selling goods from outside of EU to buyers in the EU to collect, declare and pay the VAT to the relevant tax authorities, instead of making the buyer pay the VAT at the moment the goods are imported into the EU. The IOSS scheme is applicable to both EU and non-EU companies.

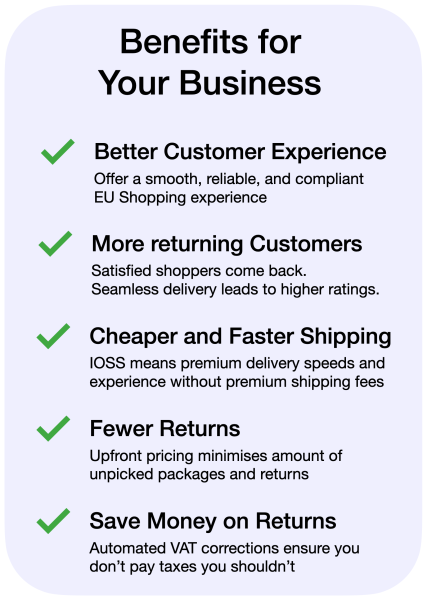

What are the advantages of IOSS?

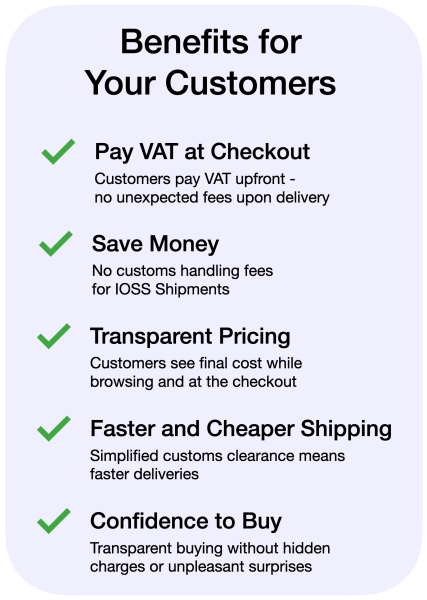

The IOSS facilitates the collection, declaration, and payment of VAT for sellers that are making distance sales of goods to buyers in the EU. The IOSS also makes the process easier for the buyer, who is only charged at the time of purchase, and therefore does not face any surprise fees when the goods are delivered. If the seller is not registered in the IOSS, the buyer has to pay the VAT and customs procedures at arrival, obscuring the total cost and increasing returns and customer dissatisfaction.

How to use IOSS?

EAS Solutions automate all of the below.

Provide the IOSS number to your logistics partner for customs clearance in the EU

Calculate and collect VAT based on VAT rates of the destination country

Display VAT at some stage of the purchase to end-customer, including the receipt

Submit an electronic monthly VAT return to the tax authorities or to the Intermediary if a non-EU seller

Make a monthly payment of the VAT declared in the VAT return to the tax authorities or to the Intermediary if a seller is based outside of the EU

Keep records of all eligible IOSS sales and/or sales facilitated over 10 years